How to write good risk scenarios and statements

Writing risk scenarios isn’t just paperwork—it’s the foundation of a great risk assessment. This guide breaks down how to build narratives that matter and turn them into crystal-clear risk statements that decision-makers can actually use.

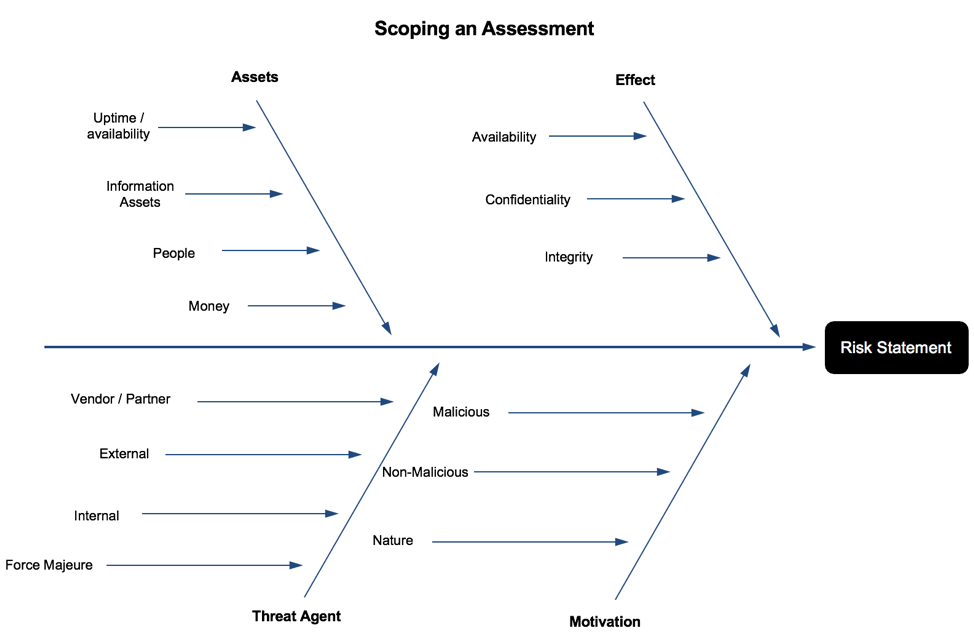

Risk management is both art and science. There is no better example of risk as an art form than risk scenario building and statement writing. Scenario building is the process of identifying the critical factors that contribute to an adverse event and crafting a narrative that succinctly describes the circumstances and consequences if it were to happen. The narrative is then further distilled into a single sentence, called a risk statement, that communicates the essential elements from the scenario.

Think of this whole process as a set-up for a risk assessment as it defines the elements needed for the next steps: risk measurements, analysis, response, and communication. Scenario building is a crucial step in the risk management process because it clearly communicates to decision-makers how, where, and why adverse events can occur.

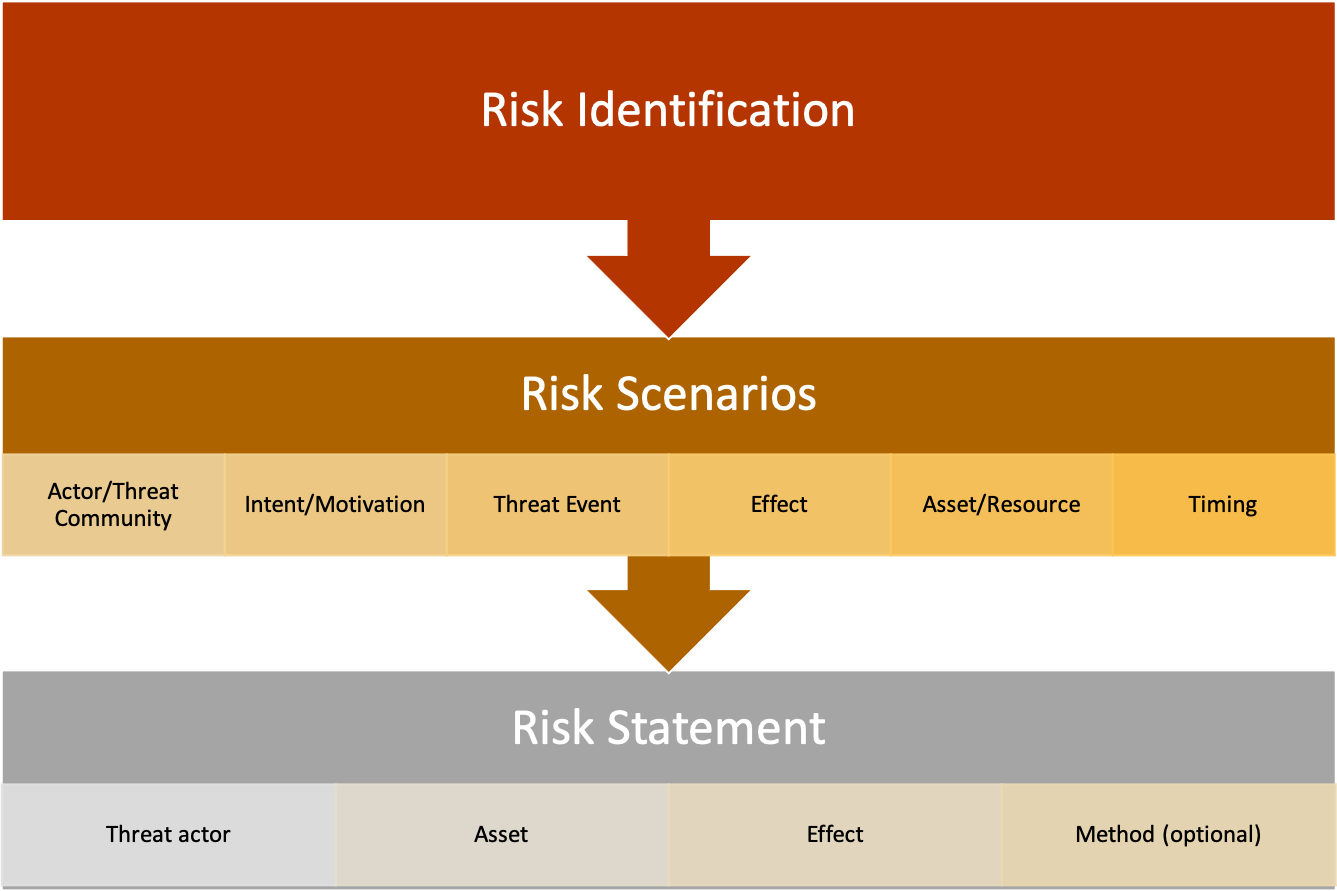

Fig. 1: Risk identification, risk scenarios, and risk statements

Risk scenarios and statements are written after risks are identified, as shown in Figure 1.

What is a risk scenario?

The concept of risk scenario building is present in one form or another in all major risk frameworks, including NIST Risk Management Framework (RMF), ISACA’s Risk IT, and COSO ERM. The above frameworks have one thing in common: the purpose of risk scenarios is to help decision-makers understand how adverse events can affect organizational strategy and objectives. The secondary function of risk scenario building, according to the above frameworks, is to set up the next stage of the risk assessment process: risk analysis. Scenarios set up risk analysis by clearly defining and decomposing the factors contributing to the frequency and the magnitude of adverse events.

See Figure 1 above for the components of a risk scenario.

Risk scenarios are most often written as narratives, describing in detail the asset at risk, who or what can act against the asset, their intent or motivation (if applicable), the circumstances and threat actor methods associated with the threat event, the effect on the company if/when it happens and when or how often the event might occur.

A well-crafted narrative helps the risk analyst scope and perform an analysis, ensuring the critical elements are included and irrelevant details are not. Additionally, it provides leadership with the information they need to understand, analyze, and interpret risk analysis results. For example, suppose a risk analysis reveals that the average annualized risk of a data center outage is $40m. The risk scenario will define an “outage,” which data centers are in scope, the duration required to be considered business-impacting, what the financial impacts are, and all relevant threat actors. The risk analysis results combined with the risk scenario start to paint a complete picture of the event and provoke the audience down the path to well-informed decisions.

For more information on risk scenarios and examples, read ISACA’s Risk IT Practitioner’s Guide and Risk IT Framework.

What is a risk statement?

It might not always be appropriate to use a 4-6 sentence narrative-style risk scenarios, such as in Board reports or an organizational risk register. The core elements of the forecasted adverse event are often distilled even further into a risk statement.

Risk statements are a bite-sized description of risk that everyone from the C-suite to developers can read and get a clear idea of how an event can affect the organization if it were to occur.

Several different frameworks set a format for risk scenarios. For example, a previous ISACA article uses this format:

[Event that has an effect on objectives] caused by [cause/s] resulting in [consequence/s].The OpenFAIR standard uses a similar format:

[Threat actor] impacts the [effect] of [asset] via (optional) [method].The OpenFAIR standard has a distinct advantage of using terms and concepts that are easily identifiable and measurable. Additionally, the risk scenario format from ISACA’s Risk IT was purpose-built to be compatible with OpenFAIR (along with other risk frameworks). The same terms and definitions used in OpenFAIR are also utilized in Risk IT.

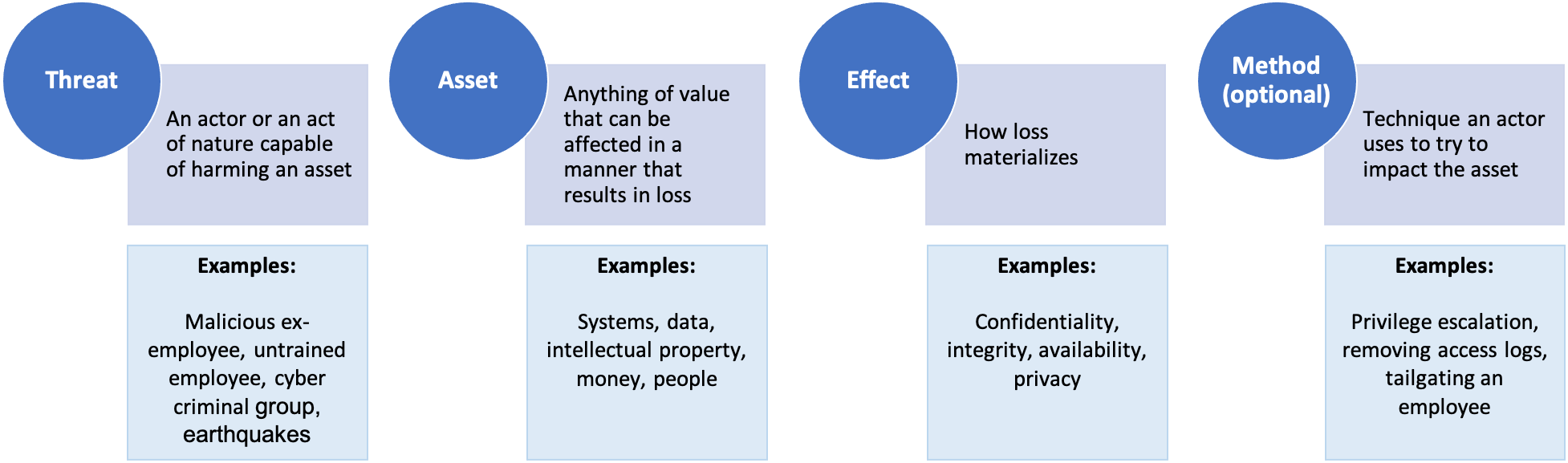

The following factors are present in an OpenFAIR compatible risk statement:

Threat actor: Describes the individual or group that can act against an asset. A threat actor can be an individual internal to the organization, like an employee. It can also be external, such as a cybercriminal organization. The intent is usually defined here, for example, malicious, unintentional, or accidental actions. Force majeure events are also considered threat actors.

Asset: An asset is anything of value to the organization, tangible or intangible. For example, people, money, physical equipment, intellectual property, data, and reputation.

Effect: Typically, in technology risk, an adverse event can affect the confidentiality, integrity, availability, or privacy of an asset. The effect could extend beyond these into enterprise risk, operational risk, and other areas.

Method: If appropriate to the risk scenario, a method can also be defined. For example, if the risk analysis is specifically scoped to malicious hacking via SQL injection, SQL injection can be included as the method.

Risk Statement Examples

Privileged insider shares confidential customer data with competitors resulting in losses in competitive advantage.

Cybercriminals infect endpoints with ransomware encrypting files and locking workstations resulting in disruption of operations.

Cybercriminals copy confidential customer data and threaten to make it public unless a ransom is paid, resulting in response costs, reputation damage and potential litigation.

Conclusion

Scenario building is one of the most critical components of the risk assessment process as it defines the scope, depth, and breadth of the analysis. It also helps the analyst define and decompose various risk factors for the next phase: risk measurement. More importantly, it helps paint a clear picture of organizational risk for leadership and other key stakeholders. It is a critical step in the risk assessment process in both quantitative and qualitative risk methodologies.

Good risk scenario building is a skill and can take some time to truly master. Luckily, there are plenty of resources available to help both new entrants to the field and seasoned risk managers hone and improve their scenario-building skills.

Additional resources on risk identification and scenario building:

ISACA’s Risk IT Practitioner’s Guide, 2nd edition

ISACA’s Risk IT Framework, 2nd edition

This article was previously published by ISACA on July 19, 2021. ©2021 ISACA. All rights reserved. Reposted with permission.

Get Practical Takes on Cyber Risk That Actually Help You Decide

Subscribe below to get new issues monthly—no spam, just signal.

Optimizing Risk Response, Unfiltered

We’ve turned risk response into a one-trick pony—mitigate, mitigate, mitigate. This post argues for something smarter: using quant to weigh all your options and finally break free from the tyranny of the risk matrix.

Sisyphus (1548–49) by Titian

I mentioned in a previous blog post that I just wrapped up two fairly large projects for ISACA: a whitepaper titled “Optimizing Risk Response” and a companion webinar titled “Rethinking Risk Response.”

The whitepaper was peer-reviewed with an academic tone. After reviewing my notes one last time, I decided to write up a post capturing some of my thoughts on the topic and process, of course, unfiltered and a little saltier than a whitepaper.

Behind the Scenes

I’m a member of ISACA’s Risk Advisory Group - a group that advises on ISACA webinars, blogs, whitepapers, journal articles, projects, and other products on the broad topic of risk. When the opportunity came up to write a whitepaper on the subject of risk response, I jumped at the chance. It seemed like a boring old topic that’s been around since the first formal risk management frameworks. I knew I needed to find a unique angle and spin on the topic to make it engaging and give risk managers something new to consider.

First came the literature review. I read the risk response sections of all major risk frameworks from technology, cybersecurity, operational risk, enterprise risk management, and even a few from financial risk. I also read blogs, articles, and project docs that included risk response topics. I came out of the literature review with a book full of notes that I summarized into the following four ideas:

The topic of risk response is not settled, especially in technology/IT risk. “Settled” means both standards bodies and practitioners generally agree on what risk response is and how to use it.

Risk response is erroneously synonymous with risk mitigation. Risk frameworks don’t make this mistake, but organizational implementations and practitioners do.

Most risk response frameworks assume the adoption of qualitative risk techniques, which makes it challenging, sometimes impossible, to weigh the pros and cons of each option. This is probably why most practitioners default to mitigate. Qualitative methods do not allow for the discrete analysis of different response options strategically applied to risk.

Employing risk response can be fraught with unintended consequences, such as moral hazard, secondary risk, and cyber insurance policy gaps.

Ah, so the angle became crystal-clear to me. The central themes of the whitepaper are:

Focusing on risk mitigation as the sole response option is inefficient.

Evaluation of each risk response option is an integral part of the risk management process.

Risk response doesn’t exist in a vacuum. It’s all part of helping the organization achieve its strategic objectives, bounded by risk tolerance.

Risk quantification is the tool you need to achieve efficient and optimized risk response, including identifying and reacting to unintended consequences.

The themes above gave the whitepaper a fresh take on an old topic. I’m also hoping that the practical examples of using risk quantification to gain efficiencies help practitioners see it as a strategic tool and nudge them closer to it.

Why Risk Response ≠ Risk Mitigation

Reacting and responding to risk is an embedded and innate part of the human psyche. All animals have a “fight or flight” response, which can be thought of as risk mitigation or risk avoidance, respectively. The concept of risk transference started forming in the 1700’s BCE with the invention of bottomry, a type of shipping insurance.

Abraham de Moivre, world’s first modern risk analyst

Abraham de Moivre, a French mathematician, changed the world in 1718 with a seemingly simple equation. He created the first definition of risk that paired the chances of something happening with potential losses.

“The Risk of losing any sum is the reverse of Expectation; and the true measure of it is, the product of the Sum adventured multiplied by the Probability of the Loss.” - Abraham de Moivre, The Doctrine of Chances (1718)

This evolved definition of risk changed the world and the way humans respond to it. Gut checks, “fight or flight,” and rudimentary forms of risk transference like bottomry were given the beginnings of an analytical framework, leading to better quality decisions. New industries were born. First, modern insurance and actuarial science (the first risk managers) sprung up at Lloyd’s of London. Many others followed. Modern risk management and analysis provided the ability to analyze response options and employ the best or a combination of the best options to further strategic objectives.

All risk management at this time was quantitative, except it wasn’t called “quantitative risk.” It was just called “risk.” Abraham de Moivre used numbers in his risk calculation, not colors. Quantitative methods evolved throughout the centuries, adding Monte Carlo methods as one example, but de Moivre’s definition of risk is unchanged - even today. If you are interested in the history of risk and risk quantification, read the short essay by Peter L. Bernstein, “The New Religion of Risk Management.”

Something changed in the late 1980’s and 1990’s. Business management diverged from all other risk fields, seeking easier and quicker methods. Qualitative analysis (colors, adjectives, ordinal scales) via the risk matrix was introduced. The new generation of risk managers using these techniques lost the ability to analytically use all options available to strategically react to risk. The matrix allows a risk manager to rank risks on a list, but not much more (see my blog post, The Elephant in the Risk Governance Room). The resulting list is best equipped for mitigation; if you have a list of 20 ranked risks, you mitigate risk #1, then #2, and so on. This is the exact opposite of an efficient and optimized response to risk.

In other words, when all you have is a hammer, everything looks like a nail.

It’s worth noting that other risk fields did not diverge in the 1980’s and 1990’s and still use quantitative risk analysis. (It’s just called “risk analysis.”)

Two examples of an over-emphasis on mitigation

The Wikipedia article on IT Risk Management (as of August 16, 2021) erroneously conflates risk mitigation with risk response. According to the article, the way an organization responds to risk is risk mitigation.

Second, the OWASP Risk Rating methodology also makes the same logical error. According to OWASP, after risk is assessed, an organization will “decide what to fix” and in what order.

To be fair, neither Wikipedia nor OWASP are risk management frameworks, but they are trusted and used by security professionals starting a risk program.

There are many more examples, but the point is made. In practice, the default way to react to IT / cyber risk is to mitigate. It’s what we security professionals are programmed to do, but if we blindly do that, we’re potentially wasting resources. It’s certainly not a data-driven, analytical decision.

Where we’re heading

We’re in a time and age in which cybersecurity budgets are largely approved without thoughtful analysis, primarily due to fear. I believe the day will come when we will lose that final bit of trust the C-Suite has in us, and we’ll have to really perform forecasts, you know, with numbers, like operations, product, and finance folks already do. Decision-makers will insist on knowing how much risk a $10m project reduces, in numbers. I believe the catalyst will be an increase in cyberattacks like data breaches and ransomware, with a private sector largely unable to do anything about it. Lawsuits will start, alleging that companies using poor risk management techniques are not practicing due care to safeguard private information, critical infrastructure, etc.

I hope the whitepaper gives organizations new ideas on how to revive this old topic in risk management programs, and this unfiltered post explains why I think the subject is ripe for disruption. As usual, let me know in the comments below if you have feedback or questions.

“Optimizing Risk Response” | whitepaper

“Rethinking Risk Response” | webinar

ISACA’s Risk Response Whitepaper Released

Most risk programs treat response as a checkbox and settle for surface-level metrics—but what if we aimed higher? This whitepaper explores how to break out of the mitigation hamster wheel and align risk response with strategy using quant-driven insights.

Photo by Marc-Olivier Jodoin on Unsplash

I recently wrapped up a true labor of love that occupied a bit of my free time in the late winter and early spring of 2021. The project is a peer-reviewed whitepaper I authored for ISACA, “Optimizing Risk Response,” released in July 2021. Following the whitepaper, I conducted a companion webinar titled “Rethinking Risk Response,” on July 29, 2021. Both are available at the links above to ISACA members. The whitepaper should be available in perpetuity, and the webinar will be archived on July 29, 2022.

The topic of risk response is admittedly old and has been around since the first technology, ERM, and IT Risk frameworks. Framework docs I read as part of my literature review all assumed qualitative risk analysis (e.g., red/yellow/green, high/medium/low, ordinal scales). Previous writings on the subject also guided the practitioner to pick one response option and move on to the monitoring phase.

In reality, risk response is much more complex. Furthermore, there’s much more quantitative risk analysis being performed than one would be led to believe by risk frameworks. Once I started pulling the subject apart, I found many ideas and opportunities to optimize risk response and management. I did my best to avoid rehashing the topic, instead focusing on the use of risk response to align with organizational strategy and identify inefficiencies.

I had two distinct audiences in mind while researching and writing the paper.

First is the risk manager. I reflected on all the conversations I’ve had over the years with risk managers who feel like they’re on a hamster wheel of mitigation. An issue goes on the risk register, the analyst performs a risk analysis, assigns a color, finds a risk owner, then lastly documents the remediation plan. Repeat, repeat, repeat. There’s a better way, but it requires a shift in thinking. Risk management must be considered an essential part of company strategy and decision-making, not an issue prioritization tool. The whitepaper dives into this shift, with tangible examples on how to uplevel the entire conversation of organizational risk.

The second audience is the consumer of risk data: everyone from individual contributors to the Board and everyone in-between. In most risk programs, consumers of risk data are settling for breadcrumbs. In this whitepaper, my goal is to provide ideas and suggestions to help risk data consumers ask for more.

If this sounds interesting to you, please download the whitepaper and watch the webinar. I strongly encourage you to join ISACA if you are not a member. ISACA has made a significant investment in the last several years in risk quantification. As a result, there are invaluable resources on the topic of risk, including a recent effort to produce whitepapers, webinars, books, and other products relating to cyber risk quantification (CRQ).

As usual, I am always interested in feedback or questions. Feel free to leave them in the comments below.

Resources:

“Optimizing Risk Response” | whitepaper

“Rethinking Risk Response” | webinar

Follow-up blog post on this topic; my unfiltered thoughts on the whitepaper

SIRAcon 2021 Talk | Baby Steps: Easing your company into a quantitative cyber risk program

Curious about bringing quant into your risk program but overwhelmed by where to start? This talk breaks it down into practical, approachable stages—so you can move beyond heatmaps without losing your team (or your sanity).

I’m pleased to announce that my talk, “Baby Steps: Easing your company into a quantitative cyber risk program”, has been accepted to SIRAcon ‘21. SIRAcon is the annual conference for the Society of Information Risk Analysts (SIRA), a non-profit organization dedicated to advancing quantitative risk analysis. The talk is scheduled for Wednesday, August 4th, 2021 at 11:15 am Eastern US time.

In the talk, I’ll be sharing tips, techniques, successes, failures, and war stories from my career in designing, implementing, and running quantitative risk programs.

Here’s the talk abstract:

Baby Steps: Easing your company into a quantitative cyber risk program

Risk managers tasked with integrating quantitative methods into their risk programs - or even those just curious about it - may be wondering, Where do I start? Where do I get the mountain of data I need? What if my key stakeholders want to see risk communicated in colors?

Attendees will learn about common myths and misconceptions, learn how to get a program started, and receive tips on integrating analysis rigor into risk culture. When it comes to quant risk, ripping the Band-Aid off is a recipe for failure. Focusing on small wins in the beginning, building support from within, and a positive bedside manner is the key to long-term success.

Update: here’s the link to the recording

Additional Resources from the Talk

It was a challenge to cram all the information I wanted to cover into 30 minutes. Sit me down with a few beers in a bar and I could talk about risk all night. This blog post is a companion piece to the talk, linking to the resources I covered and providing extra details. This post matches the flow of the talk so you can follow along.

The One Takeaway

The one takeaway from the talk is: Just be better than you were yesterday.

If you are considering or are in the process of implementing quantitative risk modeling into your risk program and you need to pause or stop for any reason, like lack of internal support, competing priorities, your executive sponsor leaves, that’s ok. There are no quant risk police to come yell at you for using a heat map.

We - the royal we - need to move off the risk matrix. The risk matrix has been studied extensively by those who study those sorts of things: data and decision scientists, engineers, statisticians, and many more. It’s not a credible and defensible decision-making tool. Having said that, the use of the risk matrix is an institutional problem. Fixing the deep issues of perverse incentives and “finger in the wind” methodologies canonized in the information security field doesn’t fall on your shoulders. Just do the best you can with what you have. Add rigor to your program where you can and never stop learning.

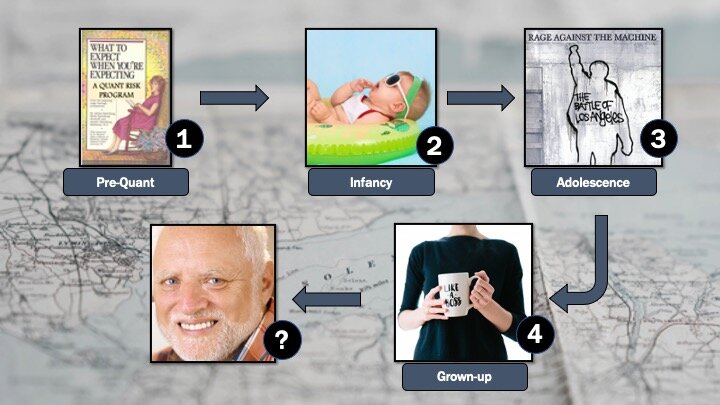

The Four Steps to a Quant Risk Program

I have four general steps or phases to help build a quant risk program:

Pre-quant: What to expect when you’re expecting a quant risk program - you are considering quantitative risk and this is how you prepare for it.

Infancy: You’ve picked a model and methodology and you’re ready for your first few steps.

Adolescence: You have several quantitative risk assessments done and you’re fully ready to rage against the qualitative machine. Not so fast – don’t forget to bring everyone along!

Grown-up: Your program is mature and you’re making tweaks, making it better, and adding rigor.

(I’ve never made it past grown-up.)

You can follow these phases in your own program, of course modifying as you see fit until your program is all quant-based. Or, use as much of this or as little as you want, maturing your program as appropriate to your organization.

Step 1: What to Expect When You’re Expecting a Quant Risk Program

In this phase, you’re setting the foundational groundwork, going to training or self-study, and increasing the rigor of your existing qualitative program.

Training - Self-Study

Reading, of course, plenty of reading.

First, some books.

Measuring and Managing Information Risk: A FAIR Approach by Jack Freund and Jack Jones

The Failure of Risk Management: Why It’s Broken and How to Fix It by Douglas Hubbard

How to Measure Anything in Cybersecurity Risk by Douglas Hubbard and Richard Seiersen

Risk Analysis: A Quantitative Guide by David Vose

Even if you don’t plan on adopting Factor Analysis of Information Risk (FAIR), I think it’s worth reading some of the documentation to help you get started. Many aspects of risk measurement covered in FAIR port well to any risk model you end up adopting. Check out the Open Group’s whitepapers on OpenFAIR, webinars, and blogs from the FAIR Institute and RiskLens.

Blogs are also a great way to stay up-to-date on risk topics, often directly from practitioners. Here are my favorites:

Exploring Possibility Space - Russell Thomas’ blog

Information Security Management - Daniel Blander’s blog

Less Wrong - Extensive site dedicated to improving reasoning and decision-making skills

The Risk Doctor - Jack Freund’s blog

Probability Management - Sam Savage’s blog

Refractor - Rob Terrin’s blog

Risk & Cybersecurity - Phil Venable’s blog

Tony Martin-Vegue's blog - this blog

Webinars

ISACA webinars (surprising amount of quant content)

Structured Training & Classes

Good Judgement Project - calibration training

Coursera - classes on prediction, probability, forecasting – generally not IT Risk classes

Add rigor to the existing program

Risk scenario building is part of every formal risk management/risk assessment methodology. Some people skip this portion or do it informally in their qualitative risk programs. You can’t take this shortcut with qualitative risk; this is the first place the risk analyst scopes the assessment and starts to identify where and how to take risk measurements.

If not already, integrate a formal scenario-building process into your qualitative risk program. Document every step. This will make moving to quantitative risk much easier.

Some frameworks that have risk scoping components are:

FAIR (risk scoping portion)

ISACA’s Risk IT Framework & Practitioner’s Guide, 2nd editions - you need to be an ISACA member, but this has an extensive list (60+) of pre-built scenarios. I recommend starting here.

Adopt a Model

What model are you going to use? Most people use FAIR, but there are others.

There are several in How to Measure Anything in Cybersecurity Risk by Doug Hubbard

Probability management (Excel plug-in's)

There are many Value-at-Risk models you can use from business textbooks, Coursera classes, business forecasting, etc.

If you have the chops, you can develop your own model

Collect Data Sources

Start collecting data sources in your qualitative program. If someone rates the likelihood and magnitude of a data breach as “high,” where could you go to get more information? Write these sources down, even if you’re not ready to start collecting data. Here are a few starting places:

Lists of internal data sources: Audits, previous assessments, incident logs and reports, vuln scans, BCP reports

External data: Your ISAC, VERIS / DBIR, Cyentia reports, SEC filings, news reports, fines & judgments from regulatory agencies

Subject matter experts: Experts in each area you have a risk scenario for; people that inform the frequency of events and the magnitude (often not the same)

Step 2: Infancy

You’ve picked a model and methodology and you’re ready for your first few steps.

Perform a risk analysis on a management decision

Find someone that has a burning question and perform a risk assessment, outside of your normal risk management process and outside the risk register. The goal is to help this individual make a decision. Some examples:

Get stakeholders accustomed to numbers

Words of Estimative Probability by Sherman Kent

Probability Survey - try this at home

Step 3 – Adolescence

You have several quant risk assessments done and are fully ready to rage against the qualitative machine – but not so fast! Don’t forget to bring everyone along!

Perform more decision-based risk assessments

In this step, perform several more decision-based risk analyses. See the list in Step 2 for some ideas. At this point, you’ve probably realized that quantitative cyber risk analysis is not a sub-field of cybersecurity. It’s a sub-field of decision science.

Check out:

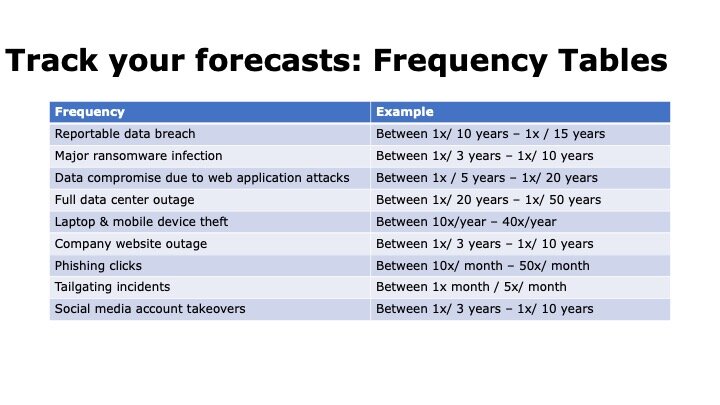

Build a Database of Forecasts

Record the frequency and magnitude forecasts for every single risk assessment you perform. You will find that over time, many assessments use the same data or, at least, can be used as a base rate. Building a library of forecasts will speed up assessments - the more you do, the faster they will be.

Some examples:

Watch Your Bedside Manner

This is the easiest tip and one that so few people do. It’s an unfortunate fact: the risk matrix is the de facto language of cyber / technology risk. It’s in the CISSP and CRISC, it’s an acceptable methodology to pass organizational audits like SOX, SOC2, and FFIEC and it’s what’s taught in university curriculums. When moving both organizations and people over to quantitative models, be kind and remember that this a long game.

Do this:

Recognize the hard work people have put into existing qualitative risk programs

Focus on improving the rigor and fidelity of analysis

Talk about what I can do for you: help YOU make decisions

Don’t do this:

Disparage previous work & effort on qualitative programs.

Quote Tony Cox in the breakroom, even though he’s right. “[Risk matrices are] worse than useless.”

Force all people to consume data one way – your way

Step 4: Grown-up

In this step, the quantitative risk program is mature and you’re making tweaks, making it better, adding rigor, and bringing people along for the risk journey. Work on converting the risk register (if you have one) and the formal risk program over to quantitative as your final big step.

Through your work, risk management and the risk register is not busywork; something you show auditors once a year. It’s used as an integral part of business forecasting, helping drive strategic decisions. It’s used by everyone, from the Board down to engineers and everyone in-between.

Here are some references to help with that transition:

Durable Quantitative Risk Programs

The last and final tip is how to make your program durable. You want it to last.

Colors and adjectives are OK, but getting stakeholders thinking in numbers will make your program last.

Reach far and wide to all areas of the business for SME inputs.

Embed your program in all areas of business decision-making.

Final Thoughts

The greatest challenge I’ve found isn’t data (or lack of), which is the most common objection to cyber risk quantification. The greatest challenge is that everyone consumes data differently. Some people are perfectly comfortable with a 5-number summary, loss exceedance curve, and a histogram. Others will struggle with decision-making with colors or numbers. Bias, comfort with quantitative data, personal risk tolerance, and organizational risk culture all play a role.

I recommend the work of Edward Tufte to help risk analysts break through these barriers and present quantitative data in a way that is easily understood and facilitates decision-making.

***

I’m always interested in feedback. It helps me improve. Please let me know what you thought of this talk and/or blog post in the comments below. What would you like to see more of? Less of?

The Elephant in the Risk Governance Room

The risk matrix might feel familiar, but it’s holding your strategy back. This post dives into the loss exceedance curve—a powerful, underused tool that transforms how leaders think about risk, investment, and value.

There is an elephant in the risk governance room.

Effective risk governance means organizations are making data-driven decisions with the best information available at the moment. The elephant, of course, refers to the means and methods used to analyze and visualize risk. The de facto language of business risk is the risk matrix, which enables conversations about threats, prioritizations and investments but lacks a level of depth and rigor to consider it a tool for strategic decision-making. However, there is a better option—one that unlocks deeper, more comprehensive conversations not only about risk, but also how risk impedes or enables organizational strategy and objectives.

Risk quantification coupled with results visualized via the loss exceedance curve (LEC) is one tool organizations can adopt to help them make informed risk investment decisions. Adopting risk quantification can help organizations unlock a true competitive advantage.

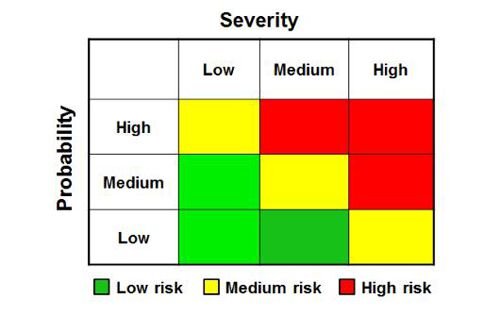

The Risk Matrix

Figure 1 gives an example of a typical risk matrix with 4 general risk themes plotted. The risk matrix is familiar to many organizations in several different industries. It is effective because it conveys, at a glance, information that helps leaders understand risk. In the example in figure 1, the risk matrix tells leadership the following:

Risk #1 seems to be about the same as risk #2.

Risk #1 and #2 are red, therefore, they should be prioritized for risk response over #3 and #4.

Risk #3 is yellow, therefore, it should be responded to, but not before #1 or #2

Figure 1— The Risk Matrix

In other words, the matrix enables conversations about the ranking and prioritization of risk.

That might seem adequate, but it does not inform the inevitable next question: Are the organization’s security expenditures cost effective and do they bring good value for the money? For example, suppose a risk manager made the statement that investing US$1 million in security controls can reduce a red risk to a yellow risk. It may be accurate, but it comes with a level of imprecision that makes determining cost effectiveness, value and cost benefit difficult, if not impossible. With the risk matrix, the conversation about risk ranking is decoupled from the conversation about how much money to spend reducing risk.

Is there a better way?

Enter the Loss Exceedance Curve

If organizations want to have deeper conversations about risk, they should consider the LEC. Like the risk matrix, it is a visual display of risk, but it has several additional advantages. One advantage is that it enables investment conversations to happen alongside risk ranking.

Figure 2 shows the same risk themes as figure 1, but they are quantified and plotted on an LEC. The LEC may be new to cyberrisk practitioners, but it is a time-tested visualization used in many disciplines, including accounting, actuarial science and catastrophe modelling.

Figure 2— Loss Exceedance Curve

Organizations can follow each risk along the curve and draw conclusions. In this example, practitioners can follow the line for ransomware and draw the following conclusions:

If a ransomware attack occurs, there is a 60% probability that losses will exceed US$20 million and a 20% probability losses will exceed US$60 million.

There is a less than 10% probability that ransomware losses will exceed US$95 million. This can be considered a worst-case outcome—a widespread, massive ransomware attack in which critical systems are affected.

The red dotted line represents the organization’s loss tolerance, which can be thought of as the red quadrants in the risk matrix. It represents more risk than the organization is comfortable with, therefore, leadership should reduce this risk through mitigation, transference, avoidance or some combination of all 3.

LECs are generated from common cyberrisk quantification (CRQ) models. OpenFAIR is one such model, but many others can be used in cyberrisk. In this case, the risk analyst would input probability and magnitude data from internal and external sources into the model and run a set number of simulations. For example, the model can be set to run 100,000 iterations, which is equivalent to 100,000 years of the organization.

Once organizations have learned how to understand the LEC, a whole new world of data interpretation becomes available. The first step in understanding the LEC is to compare how a single risk is visualized on the risk matrix vs. the LEC.

In figure 1, the risk matrix leads viewers to believe that there is 1 outcome from a ransomware attack: high risk, which is universally thought of as negative. However, the LEC shows that this is not the case. There is a wide range of possible outcomes, including losses from US$1 thousand to US$100 million. The range aligns with what is known about ransomware attacks. Losses vary greatly depending on many factors, including how many systems are compromised, when defenses detect the malware (e.g., before infection, during the attack, after the ransom demand) and if the attack is caught early enough to allow for an intervention. A single color in the risk matrix cannot communicate these subtleties, and leadership is missing out on essential investment decisions by not considering risk that exists in other colors of the risk matrix.

The LEC also enables meaningful conversations around project planning, investment decisions and deeper discussions on how to best respond to risk.

In this example, the risk matrix led the organization to believe that that the risk of ransomware and data compromise is the same (high) and that leadership should treat them equally when mitigation planning. However, the LEC shows that data compromise has higher projected losses than ransomware and by how much. Worst-case outcomes also occur at different probabilities. This difference is significant when deciding where on the curve to manage risk: most likely outcomes, worst-case outcomes or somewhere in between.

The LEC establishes a financial baseline for further analyses, such as cost/benefit, evaluating capital reserves for significant losses, evaluating insurance and control comparisons.

Conclusion

Increasingly, organizations are data-obsessed and use analysis and interpretation to make decisions, yet many still use one-dimensional tools such as the risk matrix to manage risk. It is an elephant in the proverbial decision-making room and a problem that is too big to ignore.

This article was previously published by ISACA on July 19, 2021. ©2021 ISACA. All rights reserved. Reposted with permission.

When the Experts Disagree in Risk Analysis

What do you do when one expert’s risk forecast is wildly different from the rest? This post breaks down the four common causes—and what to do when the black sheep in your risk analysis might actually be right.

Image credit: "Every family has a black sheep somewhere!" by foxypar4 is licensed under CC BY 2.0

Imagine this scenario: You want to get away for a long weekend and have decided to drive from Los Angeles to Las Vegas. Even though you live in LA, you've never completed this rite of passage, so you're not sure how long it will take given traffic conditions. Luckily for you, 5 of your friends regularly make the trek. Anyone would assume that your friends are experts and would be the people to ask. You also have access to Google Maps, which algorithmically makes predictions based on total miles, projected miles per hour, past trips by other Google Maps users, road construction, driving conditions, etc.

You ask your friends to provide a range of how long they think it will take you, specifically, to make the trip. They (plus Google) come back with this:

Google Maps: 4 hours, 8 minutes

Fred: 3.5 - 4.5 hours

Mary: 3 - 5 hours

Sanjay: 4 - 5 hours

Steven: 7 - 8 hours

Three of the four experts plus an algorithm roughly agree about the drive time. But, what's up with Steven's estimate? Why does one expert disagree with the group?

A Common Occurrence

Some variability between experts is always expected and even desired. One expert, or a minority of experts, with a divergent opinion, is a fairly common occurrence in any risk analysis project that involves human judgment. Anecdotally, I'd say about one out of every five risk analyses I perform has this issue. There isn't one single way to deal with it. The risk analyst needs to get to the root cause of the divergence and make a judgment call.

I have two sources of inspiration for this post. First, Carol Williams recently wrote a blog post titled Can We Trust the Experts During Risk Assessments? in her blog, ERM Insights, about the problem of differing opinions from experts when eliciting estimations. Second is the new book Noise by Daniel Kahneman, Olivier Sibony, and Cass R. Sunstein, covering the topic from a macro level. They define noise as "unwanted variability in judgments."

Both sources inspired and caused me to think about how, when, and where I see variability in expert judgment and what I do to deal with it. I've identified four reasons this may happen and how to best respond.

Cause #1: Uncalibrated Experts

Image credit: AG Pic

All measurement tools need to be calibrated, meaning the instrument is configured to provide accurate results within an acceptable margin of error. The human mind, being a tool of measurement, also needs to be calibrated.

Calibration doesn't make human expert judgment less wrong. Calibration training helps experts frame their knowledge and available data into a debiased estimate. The estimates of calibrated experts outperform uncalibrated experts because they have the training, practice, and learning about their inherent personal biases to provide estimates with a higher degree of accuracy.

Calibration is one of the first things I look for if an individual's estimations are wildly different from the group: have they gone through estimation and calibration training?

Solution

Put the expert through calibration training - self-study or formalized. There are many online sources to choose from, including Doug Hubbard's course and the Good Judgement Project's training.

Cause #2: Simple misunderstanding

Some experts simply misunderstand the purpose, scope of the analysis, research, or assumptions.

I was once holding a risk forecasting workshop, and I asked the group to forecast how many complete power outages we should expect our Phoenix datacenter to have in the next ten years, given that we’ve experienced two in the last decade. All of the forecasts were about the same - between zero and three. One expert came back with 6-8, which is quite different from everyone else. After a brief conversation, it turned out he misheard the question. He thought I was asking for a forecast on outages on all datacenters worldwide (over 40) instead of just the one in Phoenix. Maybe he was multitasking during the meeting. We aligned on the question, and his new estimate was about the same as the larger group.

You can provide the same data to a large group of people, and it's always possible that one or a few people will interpret it differently. If I aggregated this person's estimation into my analysis without following up, it would have changed the result and produced a report based on faulty assumptions.

Solution

Follow up with the expert and review their understanding of the request. Probe and see if you can find if and where they have misunderstood something. If this is the case, provide extra data and context and adjust the original estimate.

Cause #3: Different worldview

Your expert may view the future - and the problem - differently than the group. Consider the field of climate science as a relevant example.

Climate science forecasting partially relies on expert judgment and collecting probability estimates from scientists. The vast majority – 97% - of active climate scientists agree that humans are causing global warming. 3% do not. This is an example of a different worldview. Many experts have looked at the same data, same assumptions, same questions, and a small subgroup has a different opinion than the majority.

Some examples in technology risk:

A minority of security experts believe that data breaches at a typical US-based company aren't as frequent or as damaging as generally thought.

A small but sizable group of security experts assert that security awareness training has very little influence on the frequency of security incidents. (I'm one of them).

Some security risk analysts believe the threat of state-sponsored attacks to the typical US company is vastly overstated.

Solution

Let the expert challenge your assumptions. Is there an opportunity to revise your assumptions, data, or analysis? Depending on the analysis and the level of disagreement, you may want to consider multiple risk assessments that show the difference in opinions. Other times, it may be more appropriate to go with the majority opinion but include information on the differing opinion in the final write-up.

Keep in mind this quote:

"Science is not a matter of majority vote. Sometimes it is the minority outlier who ultimately turns out to have been correct. Ignoring that fact can lead to results that do not serve the needs of decision makers."

- M. Granger Morgan

Cause #4: The expert knows something that no one else knows

It's always possible that the expert that has a vastly different opinion than everyone else knows something no one else knows.

I once held a risk workshop with a group of experts forecasting the probable frequency of SQL Injection attacks on a particular build of servers. Using data, such as historical compromise rates, industry data, vuln scans, and penetration test reports, all the participants provided a forecast that were generally the same. Except for one guy.

He provided an estimate that forecasted SQL Injection at about 4x the rate as everyone else. I followed up with him, and he told me that the person responsible for patching those systems quit three weeks ago, no one is doing his job currently, and a SQL Injection 0-day is being actively used in the wild! The other experts were not aware of these facts. Oops!

If I ignored or included his estimates as-is, this valuable piece of information would have been lost.

Solution

Always follow up! If someone has extra data that no one else has, this is an excellent opportunity to share it with the larger group and get a better forecast.

Conclusion

Let's go back to my Vegas trip for a moment. What could be the cause of Steven's divergent estimate?

Not calibrated: He has the basic data but lacks the training on articulating that into a usable range.

Simple misunderstanding: "Oh, I forgot you moved from San Jose to Los Angeles last year. When you asked me how long it would take to drive to Vegas, I incorrectly gave you the San Jose > Vegas estimate." Different assumptions!

Different worldview: This Steven drives under the speed limit and only in the slow lane. He prefers stopping for meals on schedule and eats at sit-down restaurants - never a drive-through. He approaches driving and road trips differently than you do, and his estimates reflect this view.

Knows something that the other experts do not know: This Steven remembered that you are bringing your four kids that need to stop often for food, bathroom, and stretch breaks.

In all cases, a little bit of extra detective work finds the root cause of the divergent opinion.

I hope this gives a few good ideas on how to solve this fairly common issue. Did I miss any causes or solutions? Let me know in the comments below.

Further reading

The Sweet Spot of Risk Governance

Effective risk governance lives in the sweet spot—between reckless risk-seeking and paralyzing risk aversion. Quantification helps strike that balance, aligning security investments with business value instead of just chasing every red box to green.

"Baseball Bats, MoMA 2, New York" by Rod Waddington is licensed under CC BY-SA 2.0

In baseball, the “sweet spot” refers to the precise location on a bat where the maximum amount of energy from a batter’s swing is shifted into the ball. It is an equilibrium—the best possible outcome proportional to the amount of effort the batter exerts. A similar concept exists in risk management. IT professionals want to find the best possible balance between risk seeking and risk avoidance. Too much risk seeking leads to an organization taking wild leaps of faith on speculative endeavors, potentially leading to business failure. Extreme risk aversion, on the other hand, causes an organization to fall behind emerging trends and market opportunities—cases in point: Polaroid and Blockbuster. Finding the right balance can move an organization’s risk program from an endless cycle of opening and closing entries on a risk register to a program that truly aligns with and promotes business objectives.

Risk Seeking

Risk is not necessarily bad. Everyone engages in risky behavior to achieve an objective, whether it is driving a car or eating a hot dog. Both activities cause deaths every year, but there is a willingness to take on the risk because of the perceived benefits. Business is no different. Having computers connected to the Internet and taking credit card transactions present risk, but not engaging in those activities presents even more risk: the complete inability to conduct business. Seeking new opportunities and accepting the associated level of risk is part of business and life.

Risk Avoidance

Identifying and mitigating risk is an area where risk managers excel, sometimes to the detriment of understanding the importance of seeking risk. This can be seen especially in information security and technology risk where the impulse is to mitigate all reds to greens, forgetting that every security control comes with an opportunity cost and potential end user friction. The connection between risk, whether seeking or avoiding, and business needs to be inexorably linked if a risk management program has any chance for long-term success.

Sweet Spot

Think of risk behavior as a baseball bat. A batter should not hit the ball on the knob or the end cap. It is wasted energy. One also does not want to engage in extreme risk seeking or risk avoidance behaviors. Somewhere in the middle there is an equilibrium. It is the job of the risk manager to help leadership find the balance between risk that enables business and risk that lies beyond an organization’s tolerance.

This can be done by listening to leadership, learning where the organization’s appetite for risk lies and selecting controls in a smart, risk-aware way. Security and controls are very important. They can mitigate serious, costly risk, but balance is needed.

Risk quantification is an indispensable tool in finding and communicating balance as it helps leadership understand the amount of risk exposure in an area, by how much security controls can reduce exposure and, perhaps most important, if the cost of controls are proportional to the amount of risk reduced. The balance is a crucial part of risk governance and helps leadership connect risk to its effect on business objectives in a tangible and pragmatic way.

This article was previously published by ISACA on April 5, 2021. ©2021 ISACA. All rights reserved. Reposted with permission.

Risk modeling the vulnerability du jour, part 2: Forward-looking risk registers

Risk registers shouldn’t be a graveyard of past incidents—they should be living forecasts of future loss. Here’s how to model emerging threats like ShadowBrokers or Spectre and make your risk register proactive, not reactive.

"extreme horizon" by uair01 is licensed under CC BY 2.0

Strange, unusual, media-worthy vulnerabilities and cyberattacks… they seem to pop up every few months or so and send us risk managers into a fire drill. The inevitable questions follow: Can what happened to Yahoo happen to us? Are we at risk of a Heartbleed-type vuln? And, my personal favorite, Is this on our risk register?

This post is the second of a two-part series on how to frame, scope, and model unusual or emerging risks in your company's risk register. Part 1 covered how to identify, frame, and conceptualize these kinds of risks. Part 2, this post, introduces several tips and steps I use to brainstorm emerging risks and include the results in your risk register.

What’s a “forward-looking risk register”?

Before we get started, here’s the single most important takeaway of this blog post:

Risk registers should be forecasts, not a big ‘o list of problems that need to be fixed.

It shouldn't be a list of JIRA tickets of all the systems that are vulnerable to SQL injection, don't have working backups, or are policy violations. That's a different list.

A risk register:

Identifies the bad things that happen. For example, a threat uses SQL injection against your database and obtains your customer list

Forecasts the probability of the bad things happening, and

How much it could cost you if it does happen

In other words, risk registers look forward, not back. They are proactive, not reactive.

Including new threats and vector in your risk register

When I revamp a risk program, the first thing I do is make sure the company's risk register - the authoritative list of all risks that we know and care about - is as comprehensive and complete as possible. Next, I look for blind spots and new, emerging risks.

Here's my 4 step process to identify risk register blind spots, brainstorm new risks, how to integrate them into your register, and implement continuous monitoring.

Step 1: Inventory historical vulns and identify blind spots in your register

Run-of-the-mill risks like data breaches, outages, phishing, and fraud are easily turned into risk scenarios. It's a bit harder to identify risk blind spots. When a security incident story hits the major media and is big enough that I think I'm going to be asked about it, I start to analyze it. I look at who the threat actors are, their motivations, vector of attack, and probable impact. I then compare my analysis with the list of existing risks and ask myself, Am I missing anything? What lessons can I learn from the past to help me forecast the future?

Here are some examples:

| Vulnerability / Incident | What happened | Lessons for your risk register |

|---|---|---|

| Solarwinds hack (2020) | SolarWinds' software build process was infiltrated, giving attackers a foothold in Solarwinds customers' networks. | Software you trust gets delivered or updated with malware or provides access to system resources. |

| Target hack (2013) | Phishing email targeted at a vendor was successful, giving the attackers access to internal Target systems, leading to a breach of cardholder data. | Vendors you trust are compromised, giving attackers a foothold into your systems. |

| Sony Pictures Entertainment (SPE) (2014) | SPE released a movie that was unflattering to a particular regime, leading to a large-scale cyberattack that included ransom/extortion, massive data leaks, and a prolonged system outage. | State-sponsored groups or hacktivists are unhappy with a company's positions, products, leadership, or employee opinions and launch a cyber-attack in retaliation. |

| Rowhammer vuln | Privilege escalation and network-based attacks by causing a data leakage in DRAM. | There are hardware vulnerabilities that are OS-independent. OS/supplier diversification is not a panacea. |

| Spectre / Meltdown | An attacker exploits a vuln present in most modern CPUs, allowing access to data. | Same as above |

| Cold boot attack | An attacker with physical access to the target computer gains access to the data in memory. | You must assume that if an attacker is motivated, adequately resourced, and has the right knowledge, they can do anything with physical access to hardware. See the Evil Maid Attack. |

| Heartbleed | Bug in the OpenSSL library gives attackers access to data or the ability to impersonate sessions. | Linus’ Law (“given enough eyeballs, all bugs are shallow”) is not a risk mitigation technique. Open-source software has vulnerabilities just like commercial software, and sometimes they’re really bad. |

| Shadowbrokers leak (2016) | A massive leak of NSA hacking tools and zero-day exploits. | Criminal organizations and state-sponsored groups have some of the scariest tools and exploits and are unknown to software vendors and the general public. When these get leaked, adjust associated incident probabilities up. |

Step 2: Brainstorm any additional risks

"Brainstorms at INDEX: Views" by @boetter is licensed under CC BY 2.0

Keep it high-level and focus on resiliency instead of modeling out specific threat actions, methods, state-sponsored versus cybercriminals activity, etc. For example, you don't need to predict the next cold-boot type hardware attack. Focus on what you could do to improve overall security and resilience against scenarios in which the attackers have physical access to your hardware, whoever they may be.

Step 3: Integrate into the risk register

This step is a bit more complex, and the approach will significantly depend on your company's risk culture and what your audience expects out of a risk register.

One approach is to integrate your new scenarios into existing risk scenarios. For example, suppose you already have an existing data breach risk analysis. In that case, you can revisit the assumptions, probability of occurrence, and the factors that make up the loss side of the equation and ensure that events, such as Shadowbrokers or Target, are reflected.

Another approach is to create new risk scenarios, but this could make the register very busy with hypotheticals. Risk managers at Microsoft, the US State Department, and defense contractors probably would have a robust list of hypotheticals. The rest of us would just build the risks into existing scenarios.

Step 4: Continuous monitoring

As new attacks, methods, vectors, and vulnerabilities are made public, ask the following questions:

Conceptually and from a high level, do you have an existing scenario that covers this risk? Part 1 gives more advice on how to determine this.

Framing the event as a risk scenario, does it apply to your organization?

Is the risk plausible and probable, given your organization's risk profile? I never try to answer this myself; I convene a group of experts and elicit opinions.

In addition to the above, hold yearly emerging risk brainstorming sessions. What's missing, what's on the horizon, and where should we perform risk analyses?

I hope this gives you some good pointers to future-proof your risk register. What do you think? How do you approach identifying emerging risk? Let me know in the comments below.

Further reading

Risk modeling the vulnerability du jour, part 1: Framing

When the next headline-making exploit drops, your execs will ask, “Was this on our risk register?” This guide walks through how to proactively frame exotic or emerging threats—without falling into the FUD trap.

Every few months or so, we hear about a widespread vulnerability or cyber attack that makes its way to mainstream news. Some get snappy nicknames and their very own logos, like Meltdown, Specter, and Heartbleed. Others, like the Sony Pictures Entertainment, OPM, and Solarwinds attacks cause a flurry of activity across corporate America with executives asking their CISO’s and risk managers, “Are we vulnerable?”

I like to call these the vulnerability du jour, and I’m only half sarcastic when I say that. On the one hand, it’s a little annoying how sensationalized these are. Media-worthy vulnerabilities and attacks feel interchangeable: when one runs its course and attention spans drift, here’s another one to take its place, just like a restaurant’s soup of the day. On the other hand, if this is what it takes to get the boardroom talking about risk - I’ll take it.

When the vulnerability du jour comes on an executive’s radar, the third or fourth question is usually, “Was this on our risk register?” Of course, we don’t have crystal balls and can’t precisely predict the next big thing, but we can use brainstorming and thought exercises to ensure our risk registers are well-rounded. A well-rounded and proactive risk register includes as many of these events and vulnerabilities as possible - on a high level.

This is a two-part series, with this post (part 1) setting some basic guidelines on framing these types of risks. Part 2 gives brainstorming ideas on how to turn your risk register into one that’s forward-looking and proactive instead of reactive.

Building a forward-looking risk register means you’re holding at least annual emerging risk workshops in which you gather a cross-section of subject matter experts in your company and brainstorm any new or emerging risks to fill in gaps and blind spots in your risk register. I have three golden rules to keep in mind when you’re holding these workshops.

Golden Rules of Identifying Emerging Risk

#1: No specifics

Meteorologists, not Miss Cleo

We’re forecasters, not fortune tellers (think a meteorologist versus Miss Cleo). I don’t think anyone had “State-sponsored attackers compromise SolarWind’s source code build system, leading to a company data breach” in their list of risks before December 2020. (If you did - message me. I’d love to know if Elvis is alive and how he’s doing.)

Keep it high-level and focused on how the company can prepare for resiliency rather than a specific vector or method of attack. For example, one can incorporate the SolarWinds incident with a generalized risk statement like the example below. This covers the SolarWinds vector and other supply chain attacks and also provides a starting point to future-proof your risk register to similar attacks we will see in the future.

Attacker infiltrates and compromises a software vendor's source code and/or build and update process, leading to company security incidents (e.g. malware distribution, unauthorized data access, unauthorized system access.)The fallout from the incident can be further decomposed and quantified using FAIR’s 6 forms of loss or a similar model.

#2: Risk Quantification

The risk matrix encourages FUD (fear, uncertainty, doubt)

Communicating hypothetical, speculative, or rare risks is hard to do without scaring people. If a good portion of your company’s risk register is stuff like hypervisor escapes, privilege escalation via rowhammer, and state-sponsored attacks you really need to have the data to back up why it needs executive attention. Otherwise, it will just look like another case of FUD.

The key to success is risk quantification: risk articulated in numbers, not colors. A bunch of red high risks (or green low risks) obfuscates the true story you are trying to tell.

All risk, because it’s forward-looking, is filled with uncertainty.

Unique and exotic risks have even more uncertainty. For example, there have been so many data breaches that we have a really good idea of how often they occur and how much it costs. Supply chain attacks like SolarWinds? Not so much. Choose a risk model that can communicate both the analyst’s uncertainty and the wide range of possibilities.

I use FAIR because it’s purpose-built for information and operational risks but you really can use any quantitative model.

#3: Be aware of risk blindness

Every good risk analyst knows the difference between risks that are possible and those that are probable. Without going too deep into philosophy, just about anything is possible and it’s the risk analyst’s job to reign in people when the risk brainstorming veers to outlandish scenarios. But, don’t reign them in too much!

Any risk, no matter how routine, was unique and a surprise to someone once upon a time. Ransomware would sound strange to someone in the 1970’s; computer crime would be received as black magic to someone in the 15th century.

Try to put yourself in this mindset as you hold emerging risk workshops. I personally love holding workshops with incident responders and red teamers - they have the ability to think outside of the box and are not shy about coming up with hypotheticals and highly speculative scenarios. Don’t discourage them. Yes, we still need to separate out possible from probable, but it is an emerging risk workshop. See what they come up with.

Next Up

I hope this post got you thinking about how to add these types of risks to your register. In part 2, I’m going to give real-life examples of how to further brainstorm and workshop out these risks.

Further reading

Risk Mythbusters: We need actuarial tables to quantify cyber risk

Think you need actuarial tables to quantify cyber risk? You don’t — actuaries have been pricing rare, high-uncertainty risks for centuries using imperfect data, expert judgment, and common sense, and so can you.

Risk management pioneers: The New Lloyd's Coffee House, Pope's Head Alley, London

The auditor stared blankly at me, waiting for me to finish speaking. Sensing a pause, he declared, “Well, actually, it’s not possible to quantify cyber risk. You don’t have cyber actuarial tables.” If I had a dollar for every time I heard that… you know how the rest goes.

There are many myths about cyber risk quantification that have become so common, they border on urban legend. The idea that we need vast and near-perfect historical data is a compelling and persistent argument, enough to discourage all the but the most determined of risk analysts. Here’s the flaw in that argument: actuarial science is a varied and vast discipline, selling insurance on everything from automobile accidents to alien abduction - many of which do not have actuarial tables or even historical data. Waiting for “perfect” historical data is a fruitless exercise and will prevent the analyst from using the data at hand, no matter how sparse or flawed, to drive better decisions.

Insurance without actuarial tables

Many contemporary insurance products, such as car, house, fire, and life have rich historical data today. However, many insurance products have for decades - in some cases, centuries - been issued without historical data, actuarial tables, or even good information. For those still incredulous, consider the following examples:

Auto insurance: Issuing auto insurance was unheard of when the first policy was issued in 1898. Companies only insured horse-drawn carriages up to that point, and actuaries used data from other types of insurance to set a price.

Celebrities’ body parts: Policies on Keith Richards’ hands and David Beckham’s legs are excellent tabloid fodder, but also a great example of how actuaries are able to price rare events.

First few years of cyber insurance: Claims data was sparse in the 1970’s, when this product was first conceived, but there was money to be made. Insurance companies set initial prices based on estimates and adjacent data. Prices were adjusted as claims data became available.

There are many more examples: bioterrorism, capital models, and reputation insurance to name a few.

How do actuaries do it?

Many professions, from cyber risk to oil and gas exploration, use the same estimation methods developed by actuaries hundreds of years ago. Find as much relevant historical data as possible - this can be adjacent data, such as the number of horse-drawn carriage crashes when setting a price for the first automobile policy - and bring it to the experts. Experts then apply reasoning, judgment, and their own experience to set insurance prices or estimate the probability of a data breach.

Subjective data encoded quantitatively isn’t bad! On the contrary, it’s very useful when there is deep uncertainty, sparse data, data is expensive to acquire or a new, emerging risk.

I’m always a little surprised when people reject better methods altogether, citing the lack of “perfect data,” then swing in the opposite direction to gut checks and wet finger estimation. The tools and techniques are out there to make cyber risk quantification not only possible but could give any company a competitive edge. Entire industries have been built around less than perfect data and we as cyber risk professionals should not use a lack of perfect data as an excuse not to quantify cyber risk. If there is a value placed on Tom Jones' chest hair then certainly we can predict the loss risk of a data incident... go ask the actuaries!

Recipe for passing the OpenFAIR exam

Thinking about the OpenFAIR certification? Here's a practical, no-fluff study guide to help you prep smarter—not harder—and walk into the exam with confidence.

Passing and obtaining the OpenGroup’s OpenFAIR certification is a big career booster for information risk analysts. Not only does it look good on your CV, it demonstrates your mastery of FAIR to current and potential employers. It also makes a better analyst because it deepens one’s understanding of risk concepts that may not be often used. I passed the exam myself a while back, and I’ve also helped people prepare and study for it. This is my recipe for studying for and passing the OpenFAIR exam.

What to study

The first thing you need to understand in order to pass the exam is that the certification is based on the published OpenFAIR standard, last updated in 2013. Many people and organizations - bloggers, risk folks on Twitter, the FAIR Institute, me, Jack Jones himself - have put their own spin and interpretation on FAIR in the years since the standard was published. Reading this material is important to becoming a good risk analyst but it won’t help you pass the exam. You need to study and commit to memory the OpenFAIR standard. If you find contradictions in later texts, favor the OpenFAIR documentation.

Now, get your materials

The two most important texts are:

Open Risk Taxonomy Technical Standard (O-RT) - free, registration required

Open Risk Analysis Technical Standard (O-RA) - free, registration required

Two more optional texts, but highly recommended:

OpenFAIR Foundation Study Guide - $29.95

Measuring and Managing Information Risk: A FAIR Approach by Jack Freund and Jack Jones - book, $49.95 on Amazon

How to Study

This is how I recommend you study for the exam:

Thoroughly read the Taxonomy (O-RT) and Analysis (O-RA) standards, cover to cover. Use the FAIR book, blogs, and other papers you find to help answer questions or supplement your understanding, but use the PDF’s as your main study aid.

Start memorizing - there are only three primary items that require rote memorization; everything else is common sense if you have a mastery of the materials. Those items are:

The Risk Management Stack

You need to know what they are, but more importantly, you need to know them in order.

Accurate models lead to meaningful measurements, which lead to effective comparisons - you get the idea. The test will have several questions like, “What enables well-informed decisions?” Answer: effective comparisons. I never did find a useful mnemonic that stuck like Please Don’t Throw Sausage Pizzas Away, but try to come up with something that works for you.

The FAIR Model

You are probably already familiar with the FAIR model and how it works by now, but you need to memorize it exactly as it appears on the ontology.

The FAIR model (source: FAIR Institute)

It’s not enough to know that Loss Event Frequency is derived from Threat Event Frequency and Vulnerability - you need to know that Threat Event Frequency is in the left box and Vulnerability is on the right. Once a day, draw out 13 blank boxes and fill them in. The test will ask you to match various FAIR elements of risk on an empty ontology. You also need to know if each element is a percentage or a number. This should be easier to memorize if you have a true understanding of the definitions.

Forms of Loss

Last, you need to know the six forms of loss. You don’t need to memorize the order, but you definitely need to recognize these as the six forms of loss and have a firm understanding of the definitions.

Productivity Loss

Response Loss

Replacement Loss

Fines and Judgements

Competitive Advantage

Reputation Damage

Quiz Yourself

I really recommend paying the $29.95 for the OpenFAIR Foundation Study Guide PDF. It has material review, questions/answers at the end of each chapter, and several full practice tests. The practice tests are so similar (even the same, for many questions) to the real test, that if you ace the practice tests, you’re ready. Also, check out FAIR certification flashcards for help in understanding the core concepts.

When you think you’re ready, register for your exam for a couple of weeks out. This gives you time to keep taking practice tests and memorizing terms.

In Closing…

It’s not a terribly difficult test, but you truly need a mastery of the FAIR risk concepts to pass. I think if you have a solid foundation in risk analysis in general, it takes a few weeks to study, as opposed to months for the CRISC or CISSP.

Good luck with your FAIR journey! As always, feel free to reach out to me or ask questions in the comments below.

Book Review | The Failure of Risk Management: Why It's Broken and How to Fix It, 2nd Edition

Doug Hubbard’s The Failure of Risk Management ruffled feathers in 2012—and the second edition lands just as hard, now with more tools, stories, and real-world tactics. If you’ve ever been frustrated by heat maps, this book is your upgrade path to real, defensible risk analysis.

When the first edition of The Failure of Risk Management: Why It's Broken and How to Fix It by Douglas Hubbard came out in 2012, it made a lot of people uncomfortable. Hubbard laid out well-researched arguments that some of businesses’ most popular methods of measuring risk have failed, and in many cases, are worse than doing nothing. Some of these methods include the risk matrix, heat map, ordinal scales, and other methods that fit into the qualitative risk category. Readers of the 1st edition will know that the fix is, of course, methods based on mathematical models, simulations, data, and evidence collection. The 2nd edition, released in March 2020, builds on the work of the previous edition but brings it into 2020 with more contemporary examples of the failure of qualitative methods and tangible advice on how to incorporate quantitative methods into readers’ risk programs. If you considered the 1st edition required reading, as many people do (including myself), the 2nd edition is a worthy addition to your bookshelf because of the extra content.

The closest I’ll get to an unboxing video

The book that (almost) started it all

I don’t think it would be fair to Jacob Bernoulli’s 1713 book Ars Conjectandi to say that the first edition of The Failure of Risk Management started it all, but Hubbard’s book certainly brought concepts such as probability theory into the modern business setting. Quantitative methodologies have been around for hundreds of years, but in the 1980’s and ‘90’s people started to look for shortcuts around the math, evidence gathering, and critical thinking. Those companies starting using qualitative models (e.g., red/yellow/green, high/medium/low, heat maps) and these, unfortunately, became the de facto language of risk in most business analysis. Hubbard noticed this and carefully laid out an argument on why these methods are flawed and gave readers tangible examples of how to re-integrate quantitative methodologies into decision and risk analysis.

Hubbard eloquently reminds readers in Part Two of his new book all the reasons why qualitative methodologies have failed us. Most readers should be familiar with the arguments at this point and will find the “How to Fix It” portion of the book, Part Three, a much more interesting and compelling read. We can tell people all day how they’re using broken models, but if we don’t offer an alternative they can use, I fear arguments will fall on deaf ears. I can't tell you how many times I've seen a LinkedIn risk argument (yes, we have those) end with, “Well, you should have learned that in Statistics 101.” We’ll never change the world this way.

Hubbard avoids the dogmatic elements of these arguments and gives all readers actionable ways to integrate data-based decision making into risk programs. Some of the topics he covers include calibration, sampling methods for gathering data, an introduction to Monte Carlo simulations, and integrating better risk analysis methods into a broader risk management program. What's most remarkable isn't what he covers, but how he covers it. It’s accessible, (mostly) mathless, uses common terminology, and is loaded with stories and anecdotes. Most importantly, the reader can run quantitative risk analysis with Monte Carlo simulations from the comfort on their own computer with nothing more than Excel. I know that Hubbard has received criticism for using Excel instead of more typical data analysis software, such as Python or R, but I see this as a positive. With over 1.2 billion installs of Excel worldwide, readers can get started today instead of learning how to code and struggling with installing new software and packages. Anyone with motivation and a computer can perform quantitative risk analysis.

What’s New?

There are about 100 new pages in the second edition, with most being new content, but some readers will recognize concepts from Hubbard’s newer books, like the 2nd edition of How to Measure Anything and How to Measure Anything in Cybersecurity Risk. Some of the updated content includes:

An enhanced introduction, that includes commentary on the many of the failures of risk management that has occurred since the 1st edition was published, such as increased cyber-attacks and the Deepwater Horizon oil spill.

I was delighted to see much more content around how to get started in quantitative modeling in Part 1. Readers only need a desire to learn, and not a ton of risk or math experience to get started immediately.

Much more information is provided on calibration and how to reduce cognitive biases, such as the overconfidence effect.

Hubbard beefed up many sections with stories and examples, helping the reader connect even the most esoteric risk and math concepts to the real world.

Are things getting better?